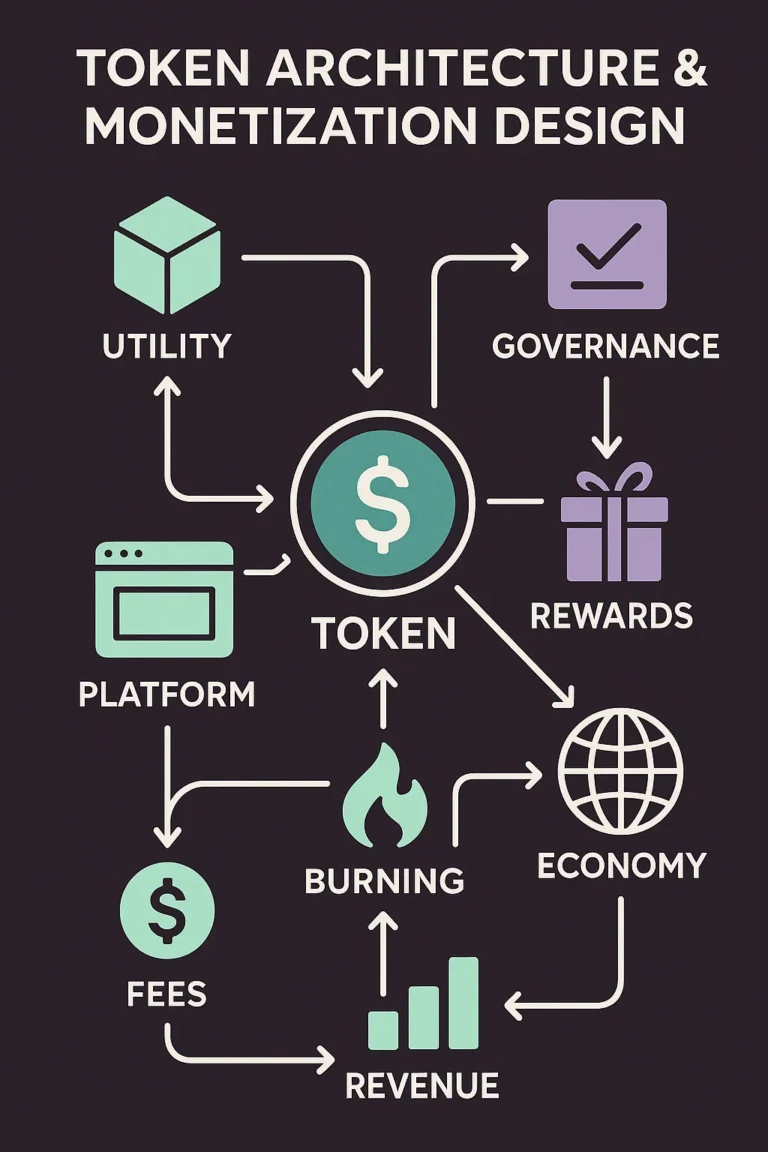

Building a token economy in 2025 is no longer just about writing smart contracts or designing hype-fueled launches. It’s a strategic balancing act—one that sits at the intersection of technology, finance, community, and regulation. As institutional capital returns to Web3 and governments crack down on anything that smells like financial engineering, designing a functional token isn’t enough. It must be resilient, compliant, and aligned with real-world usage.

In this piece, I break down the latest thinking around token design: what works, what fails, and how to architect models that grow with your ecosystem, rather than collapse under volatility or legal pressure.

What You Need to Get Right from the Start

1. Token Classification: Know What You’re Issuing

Before you even write a line of code, you need to define exactly what kind of token you’re creating—and why. Is it a utility token, granting access to your platform or services? A governance token, letting users help shape protocol direction? Or a security token, offering yield or ownership-like rights? This isn’t just about semantics. In 2025, regulators across the U.S., EU, and Asia are drawing clear lines. Misclassify your token, and you may face delistings, enforcement, or worse. Smart founders are bringing in legal advisors early, mapping token roles to actual functionality, and baking compliance logic directly into their whitepapers and smart contracts.

2. Emissions & Supply: Design with Discipline

A token’s supply mechanics are its heartbeat. Too much inflation, and you devalue your network. Too rigid a cap, and you starve growth.

The best teams today are shifting to milestone-based emissions—tying token releases to actual achievements: daily users, validator growth, or protocol TVL. Burn mechanisms, like fee destruction or treasury buybacks, are no longer exotic—they’re expected. Think of your emissions like a monetary policy: adaptive, transparent, and rooted in network fundamentals.

3. Incentive Alignment: Reward the Right Behaviors

In a decentralized world, alignment is the glue. Your users, builders, investors, and stewards all need different kinds of incentives—but they must point in the same direction.

- Users earn tokens by contributing—staking, creating content, referring new members, or participating in governance.

- Builders are compensated based on verifiable milestones, not vague promises.

- Investors benefit from structured unlocks and liquidity plans that support long-term value, not pump-and-dump cycles.

- Communities should hold real power—not just token-weighted votes, but participatory rights that scale with their contribution.

Incentive systems that don’t evolve become loopholes. Protocols in 2025 are increasingly embracing dynamic incentives—reward structures that adjust in real time based on user behavior, on-chain data, and participation rates.

4. Governance & Upgradeability: Decentralized, Not Disorganized

Governance is where many projects stumble. It’s not enough to say “we’re a DAO.” You need to operationalize decentralization—with systems that protect against plutocracy, voter apathy, and silent centralization.

Effective protocols today:

- Use delegated voting with time-locks and quorum thresholds.

- Build modular, upgradeable contracts to adapt without hard forks.

- Shift progressively from core team control to community stewardship—with phased handovers, documented voting rules, and transparent treasury oversight.

Poor governance kills trust. Mature governance builds it.

5. Compliance: Design for Regulation from Day One

Compliance used to be optional. Now it’s existential.

- In the U.S., regulators are treating any yield-bearing token as a security.

- In Europe, MiCA is fully live, requiring stablecoin issuers to hold reserves, register whitepapers, and seek licensing.

- Across Asia, the approach is function-first: it doesn’t matter what you call your token—what matters is what it does.

Protocols that are succeeding in 2025 have compliance baked in. That means:

- KYC and AML from the start.

- Jurisdictional blocklisting.

- Investor protection disclosures.

- Audit-ready flows and treasury transparency.

Far from slowing growth, compliance now accelerates it by unlocking listings, partnerships, and cross-border expansion.

Token Design in Practice

Let’s break this into tactical layers.

Token Types: Don’t Blur the Lines

- Utility Tokens unlock access to features or services. No financial upside.

- Governance Tokens give voice—proposals, votes, and steering power.

- Security Tokens mirror traditional assets—dividends, interest, or ownership.

Yes, hybrid tokens exist. But clarity still wins. Stakeholders, regulators, and exchanges want to understand what they’re dealing with. Define it. Document it. Defend it.

Stakeholder Incentives: Go Beyond the Airdrop

Your community is more than users—they’re co-builders.

- Incentives must evolve with engagement.

- Vesting schedules should match value delivery.

- Governance rewards should go beyond holding tokens—participation needs to be rewarded.

Protocols that incentivize deeply and fairly grow organically. Those that over-reward speculators die quickly.

Emission Models: Stop Copying Bitcoin

Bitcoin’s halving model works for Bitcoin. It may not work for your project.

Instead:

- Let emissions track real milestones, not arbitrary dates.

- Use burn models tied to real usage.

- Cap supply only if demand warrants it.

- Add velocity and staking analysis to your dashboard—in real time.

Token design today looks more like economic modeling than game theory.

Governance: Treat It Like Infrastructure

Think of governance like your protocol’s nervous system:

- Multi-tier voting adds both speed and safety.

- Proposal gates protect against spam and bad actors.

- Treasury visibility builds trust and fuels long-term planning.

- Upgrade paths ensure flexibility without chaos.

If your governance can’t evolve, your protocol won’t either.

Lessons from the Field

Axie Infinity (SLP)

Axie’s SLP token saw runaway inflation and user fatigue. The fix? Hard caps, burn mechanics, and tying emissions directly to ecosystem usage. While the early hype faded, these structural changes helped stabilize long-term value.

Helium (HNT)

Helium created one of the cleanest incentive systems by tying token minting to real-world activity—users deploy hardware, earn tokens. Their burn-to-mint mechanism ensures supply only grows when network value does. That’s how tokenomics should work.

The Regulatory Reality Check

As of July 2025:

- The U.S. SEC treats most yield mechanisms as securities. If it walks like a dividend…

- The EU’s MiCA requires full documentation, stablecoin licensing, and capital backing.

- Asian jurisdictions look at function, not naming—if your token acts like a bond, it’s regulated like one.

Common Mistakes (and How to Avoid Them)

What Not to Do:

- Release 70% of your supply in year one.

- Tie rewards to speculation, not contribution.

- Let governance decay into a ghost town.

- Ignore legal counsel.

- Run your treasury from a hot wallet with no oversight.

What the Best Teams Do:

- Use adaptive emissions tied to product KPIs.

- Link burn mechanics to real platform usage.

- Launch with upgradeable, audited contracts.

- Publish and maintain a governance playbook.

- Track everything—from token velocity to staking participation—live.

Final Thoughts: Design for the Long Run

A token economy isn’t built on hype or charts—it’s built on structure. Every decision—classification, emissions, incentives, governance, legal—must work together. Get it right, and your protocol can survive bear markets, regulatory shifts, and whatever comes next.