Beyond the GameWelcome to the third edition of our newsletter exploring transformative trends in technology! This time, we dive into how Web3 is reshaping digital economies, particularly in emerging markets, where access to traditional financial systems can be limited. From decentralized finance (DeFi) to tokenized assets, Web3 is empowering communities, fostering inclusion, and unlocking new economic opportunities.

The Web3 Revolution: A Primer

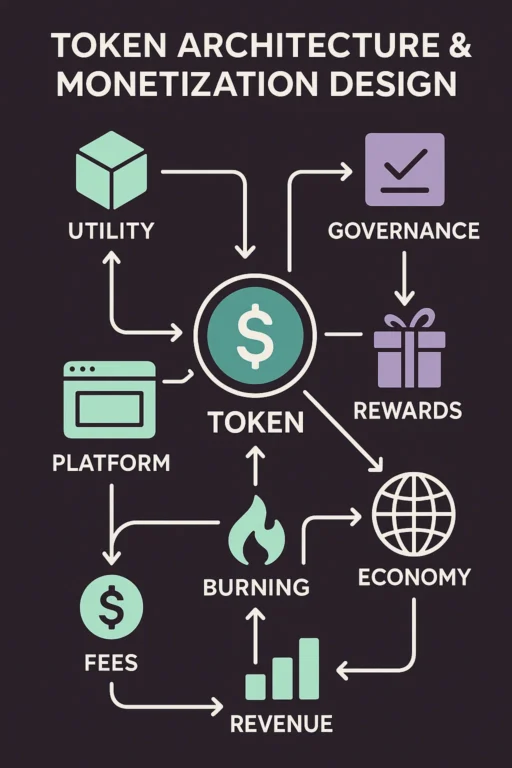

Web3, often described as the next evolution of the internet, leverages blockchain technology to create decentralized, transparent, and user-controlled digital ecosystems. Unlike Web2, where platforms like banks or tech giants hold significant control, Web3 shifts power to individuals through peer-to-peer networks, smart contracts, and cryptocurrencies. For emerging markets—where infrastructure gaps and financial exclusion are common—this decentralized approach is proving to be a game-changer.

Why Emerging Markets?

Emerging markets, spanning regions like Sub-Saharan Africa, Southeast Asia, and Latin America, face unique challenges: limited banking access, high remittance fees, and currency volatility. According to the World Bank, over 1.4 billion people globally remain unbanked, with a significant portion in these regions. Web3 technologies address these pain points by offering:

- Financial Inclusion through DeFi: Decentralized finance platforms allow users to access loans, savings, and investments without traditional intermediaries. For example, platforms like Aave and Compound enable users in Nigeria or India to earn interest or borrow against crypto assets using just a smartphone and internet connection.

- Lower-Cost Remittances: Cross-border payments in emerging markets often incur fees as high as 7-10%. Blockchain-based solutions like Stellar or Ripple reduce costs to fractions of a percent, enabling migrant workers to send money home affordably.

- Digital Identity and Ownership: Web3’s non-fungible tokens (NFTs) and decentralized identity systems empower individuals to own and verify their digital assets and identities. In regions with weak institutional trust, this fosters security and autonomy.

Real-World Impact: Stories from the Ground

Case Study 1: DeFi in Kenya

In Kenya, where mobile money platforms like M-Pesa dominate, DeFi protocols are gaining traction. Farmers in rural areas are using platforms like Celo to access microloans in stablecoins, bypassing volatile local currencies. These loans help purchase seeds or equipment, boosting agricultural productivity. By 2024, Celo reported over 500,000 active wallets in Africa, a testament to DeFi’s growing reach.

Case Study 2: NFT Marketplaces in Southeast Asia

In the Philippines, artists and creators are tapping into NFT marketplaces like OpenSea to sell digital art globally. This bypasses traditional barriers like gallery access or international banking, allowing creators to earn directly in cryptocurrency. For instance, Filipino artist Juan Dela Cruz sold an NFT collection for $10,000, a sum that would have been unattainable through local markets.

Case Study 3: Blockchain for Supply Chains in Latin America

In Brazil, small-scale coffee farmers are using blockchain to trace their products from farm to consumer. Platforms like IBM’s Food Trust ensure transparency, helping farmers secure fair prices by proving the authenticity and sustainability of their goods. This builds trust and opens access to global markets.

Challenges and the Road Ahead

While Web3 holds immense promise, challenges remain:

- Infrastructure Gaps: Reliable internet and smartphone penetration are prerequisites for Web3 adoption, yet many rural areas lack both.

- Regulatory Uncertainty: Governments in emerging markets are still grappling with how to regulate cryptocurrencies and DeFi, with some imposing restrictive policies.

- Education and Awareness: Many potential users lack the technical knowledge to navigate Web3 platforms safely.

However, these hurdles are not insurmountable. Initiatives like Chainlink’s CCIP (Cross-Chain Interoperability Protocol) are simplifying blockchain interactions, while local startups are offering user-friendly apps tailored to regional needs. Governments are also beginning to explore blockchain for public services, such as land registries in India and voting systems in Estonia.

The Future of Digital Economies

Web3 is not just a technological shift; it’s a paradigm change that empowers individuals in emerging markets to participate in the global economy on their terms. By democratizing access to finance, ownership, and opportunity, Web3 is laying the foundation for more inclusive and resilient digital economies.

As we move forward, collaboration between innovators, policymakers, and communities will be key to unlocking Web3’s full potential. Let’s continue to explore, build, and support this transformative wave.

What are your thoughts on Web3’s impact in emerging markets? Share your insights or experiences below, and let’s keep the conversation going!

Stay tuned for our next edition, where we’ll explore AI’s role in sustainable development.