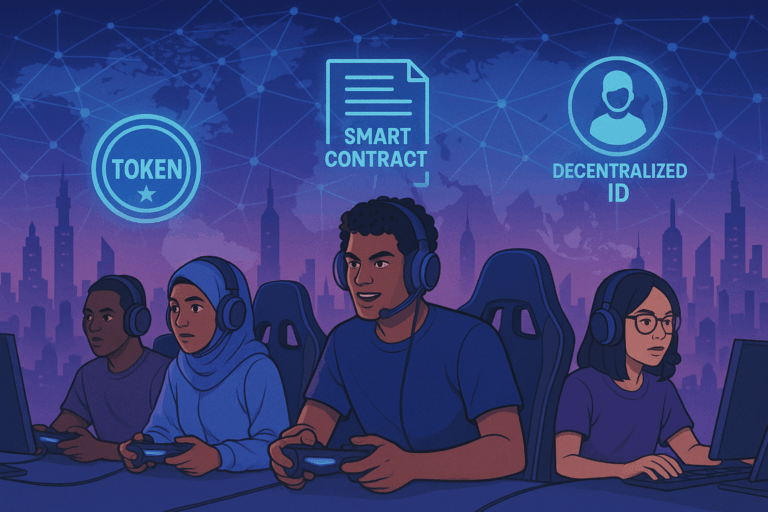

Tokenized engagement turns passive audiences into active stakeholders. By issuing branded tokens, creators, sports teams, or entertainment franchises give fans a direct economic and reputational stake in the community’s success.

When tokens double as access keys, voting chips, or loyalty points, participation becomes measurable and rewarded in real time. Fans can unlock exclusive content, early‑bird tickets, or governance rights simply by holding or staking the asset.

Successful platforms focus on three pillars:

- Utility – Tokens must do something beyond trading. Think gated experiences, discounts, or cross‑platform perks.

- Community Governance – Let holders influence decisions: event locations, merch designs, or content roadmaps.

- Liquidity & On‑Ramps – Easy fiat on‑ramps and cross‑chain bridges ensure fans anywhere can participate without friction.

The Evolution of Fan Economies

From radio call‑ins to social media likes, fans have always sought ways to feel closer to the brands, teams, and creators they love. Web3 accelerates that trend by turning attention into ownership. Instead of passively consuming content, supporters can now hold tokens that represent both cultural and economic stakes in a community. This shift redefines fandom from a one‑way broadcast model to a two‑way marketplace where value flows in multiple directions.

Early experiments like Patreon and Kickstarter proved that audiences will financially back creators when given clear incentives. Tokenization takes the concept further by adding liquidity and programmability. A supporter can crowdfund a project, earn governance rights, trade those rights on secondary markets, or use them to unlock exclusive experiences. The result is a living economy that evolves with every new piece of content, event, or collaborative decision.

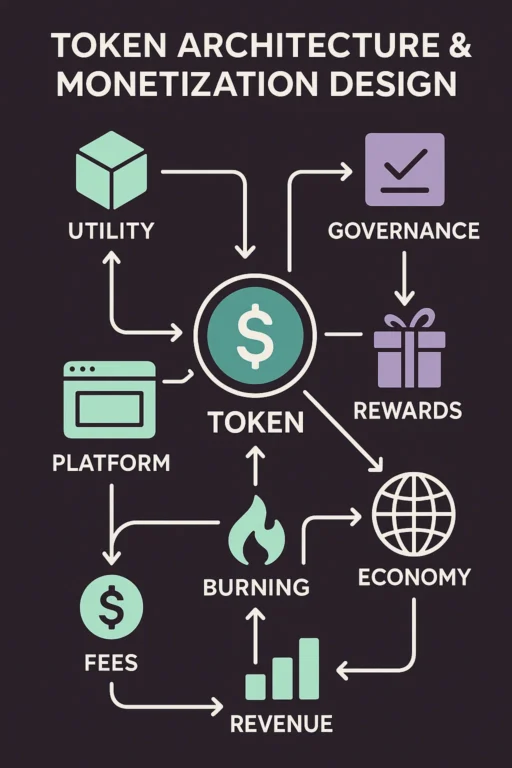

Token Utility Layers

A successful fan token often operates on three interconnected layers:

- Access – Basic ownership grants entry to gated Discord channels, behind‑the‑scenes footage, or members‑only merchandise drops.

- Influence – Governance modules let holders vote on set lists, jersey designs, or charitable donations, creating a sense of co‑creation.

- Financial Upside – Tokens can accrue staking rewards, profit‑sharing dividends, or resale royalties, aligning economic incentives with community growth.

Balancing these layers is crucial. Too much financial upside without real utility invites speculation; too little upside can limit adoption to only the most passionate superfans. Projects like FC Barcelona’s BAR token and FWB (Friends With Benefits) illustrate how tiered utility models can satisfy both casual supporters and power users.

Governance Mechanisms

Decentralized governance transforms fans from spectators into stakeholders. Snapshot voting, quadratic funding, and reputation‑weighted ballots are popular tools for gauging community sentiment. The key is to match decision scope with token holder expertise: a music DAO might let fans pick tour cities but leave complex production budgets to a core team.

Progressive decentralization—starting with advisory polls and moving toward binding votes—helps avoid decision paralysis in early stages. Multi‑sig councils or elected committees can act as stewards, executing on‑chain proposals once quorum is met. Clear proposal templates, discussion forums, and transparent vote tracking foster trust and reduce governance fatigue.

Monetization Strategies

Tokenized platforms unlock diverse revenue streams beyond traditional ticket sales and ad impressions:

- Primary Sales – Initial token offerings, NFT drops, or limited‑edition merchandise.

- Secondary Royalties – Smart contracts can route a percentage of peer‑to‑peer trades back to creators or community treasuries.

- Staking & Yield – Holders can lock tokens to earn additional rewards, boosting retention while securing network functions.

- Dynamic Pricing – Bonding curves adjust token prices in real time based on demand, creating transparent market dynamics.

Importantly, monetization must align with regulatory frameworks. Revenue‑sharing tokens may trigger securities laws, while over‑promising financial returns can violate consumer‑protection statutes. Legal counsel and jurisdiction‑specific disclosures are non‑negotiable.

Case Studies

Socios & Chiliz

Socios pioneered fan tokens for elite sports clubs, issuing fungible assets that grant voting rights on club decisions like anthem songs or bus designs. The platform’s partnership model channels a portion of token sale proceeds back to teams, creating a win‑win revenue loop. However, fluctuating token prices have raised questions about speculative risk for casual fans, prompting Socios to invest heavily in educational content and fiat on‑ramps.

NBA Top Shot

Built on the Flow blockchain, NBA Top Shot turned video highlights into scarce digital collectibles. While not a fungible fan token, Top Shot moments function as cultural assets that appreciate with player performance and hype cycles. The project illustrates how scarcity mechanics and official licensing can drive mainstream adoption—Top Shot surpassed $1 billion in sales within its first year, attracting both crypto natives and basketball enthusiasts.

Seoul Stars

K‑Pop virtual idol project Seoul Stars issues $SSTAR tokens that allow fans to vote on song releases and choreography. Revenue from streaming and virtual concerts flows back into a community treasury, which token holders govern. The model showcases how digital‑native entertainment properties can launch with a Web3‑first strategy, bypassing traditional record labels.

Compliance and UX

Frictionless user experience is the linchpin of mass adoption. Projects must abstract away private keys, gas fees, and complex wallet setups. Custodial solutions or social logins can onboard non‑crypto audiences, while progressive disclosure educates users as they advance from novice to power participant.

On the compliance front, jurisdictions like the EU (MiCA) and the U.S. (FinCEN, SEC) impose AML/KYC and consumer‑protection requirements. Implementing tiered verification—light KYC for low‑value transactions, full KYC for higher tiers—balances regulatory obligations with user privacy. Transparent terms of service and risk disclosures further safeguard both issuers and participants.

Future Outlook

As Layer‑2 networks reduce transaction costs and account abstraction simplifies wallets, fan tokens will blur the line between social media and financial products. Expect:

- Cross‑Platform Portability – Tokens that unlock perks across multiple games, events, or content platforms.

- Dynamic Reputation Scores – On‑chain metrics that reward positive community behavior and penalize spam or toxicity.

- AI‑Powered Personalization – Machine learning models that tailor rewards and content based on wallet activity.

Ultimately, tokenized engagement transforms fandom into a collaborative economy where creators and supporters share upside, governance, and cultural ownership. The projects that succeed will marry robust tokenomics with intuitive UX and ironclad compliance, turning spectators into stakeholders for the long haul.studies like Chiliz/Socios, NBA Top Shot, and fan‑owned esports orgs show how tokenized engagement deepens loyalty while opening new revenue channels.

In upcoming articles we’ll explore tooling, compliance, and UX best practices for launching your own fan token.