Why this playbook matters

Digital tokens promise a future where value moves as fluidly as data, but most projects burn out before they light the runway. The culprit is predictable: they pour rewards into the market long before anyone has a meaningful reason to use the token. Prices spike, speculators celebrate, and early adopters cash out—leaving everyday users holding a rapidly deflating bag.

After watching this pattern repeat across gaming, media and fintech pilots, I now open every board meeting with the same directive: prioritise token sinks before rewarding faucets. Sinks—mechanisms that burn, lock or stake tokens—act as the economy’s braking system. They slow speculative churn, fund long‑term treasuries and, most importantly, signal to regulators and users that the project values stability over short‑term optics.

This guide translates that mantra into actionable steps any C‑suite can champion without reading a single line of smart‑contract code.

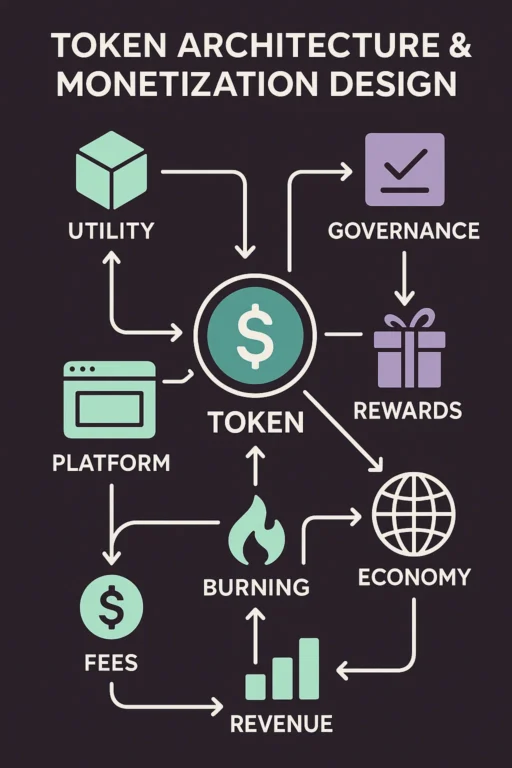

The value‑loop mindset

Tokens should behave like well‑designed air‑miles: earn them by contributing, spend them on experiences that create new loyalty, and reinvest a slice of every transaction back into system upgrades. When the loop is tight, each turn reinforces the product’s utility and tamps down uncontrolled velocity.

Conversely, when the loop is leaky—earn actions outnumber spend moments three‑to‑one—supply balloons and user enthusiasm drops faster than engagement metrics during a service outage.

I encourage executives to visualise the loop as a flywheel, not a pipeline: revenue, retention and reputation compound only when value circulates smoothly through every stage.

Earn — Tokens enter circulation as a by‑product of desirable growth behaviours: competitive wins, content views, successful referrals. Each issuance must be defensible in a board deck.

Spend — Holders remove or sequester tokens in exchange for status, utility or returns. Supply contraction begins here.

Enjoy — Benefits must be immediate and obvious; delayed gratification kills momentum. Think the same‑session perks, not quarterly sweepstakes.

Reinvest — Treasury siphons off a fraction of every burn or fee, underwriting the next wave of product features and marketing campaigns.

Board KPI: Maintain an Earn‑to‑Spend ratio within 1:1 ±10 % for the first three months. Anything wider and inflation becomes an uninvited board member.

Five board‑approved sink strategies

Executives often ask which sinks produce the strongest behavioural anchors. After two dozen deployments, these five consistently deliver measurable reductions in token velocity while lifting retention and lifetime value.

1. Premium Access – Burning tokens to unlock gated experiences—be it front‑row e‑tickets or invite‑only Discord lounges—turns digital scarcity into social capital. Scarcity drives urgency; burned supply never re‑enters the market, cushioning price volatility.

2. Tiered Upgrades – Crafting systems that combine low‑tier assets with tokens to mint rare skins or badges satisfy both collectors and traders. By tying rarity to token destruction, the project secures a predictable deflation schedule.

3. Locked‑Staking Perks – Time‑bound vaults that exchange a 30–90 day lock for fee rebates or yield boosters lengthen average holding periods, straightening out supply curves and providing CFOs with clearer cash‑flow forecasts.

4. Time‑Weighted Governance – Weighting votes by lock duration filters out speculative whales and encourages mission‑aligned holders to steer strategic decisions, reducing governance capture risk.

5. Real‑World Redemption – Allowing tokens to be burned at point‑of‑sale for physical merchandise or tickets validates the asset’s purchasing power outside of cyberspace and invites mainstream partnerships that bring fresh liquidity.

CEO takeaway: sign off on one sink that excites high‑value whales and another that delights casual newcomers. Diversified sinks equal diversified commitment.

Case spotlight — Quest League

Quest League, a mid‑tier MOBA circuit in Southeast Asia, serves as an instructive microcosm (which is a trailblazer in the world of loyalty programs and NFT ticketing).

Management green‑lit only one sink at launch—burn 50 tokens to display a season‑exclusive badge on Twitch overlay. Faucets remained dormant for the first fortnight. The immediate result was a social‑media flood of badge screenshots, which doubled as organic marketing. Over 30 days, token velocity clocked in at 5.2 turns per month, comfortably within the 4–7 sweet spot.

Simultaneously, 11 percent of outstanding supply exited circulation via burns, and fee revenue filled a dormant treasury wallet to the tune of $6 000. With that war chest, Quest League funded a surprise mid‑season show match, creating a feedback loop that translated on‑chain scarcity into off‑chain buzz.

Leadership lessons are clear: a single, aspirational sink can arrest speculative churn, finance growth initiatives and, when publicly reported, convert fence‑sitters into evangelists.

90‑day C‑suite action calendar

Days 1–30 — Strategy

Finalise tokenomics with finance; secure external legal opinion; approve two sink mechanisms; and obtain a memorandum of understanding with at least one merchant willing to accept burned‑token redemptions.

Days 31–60 — Build & Validate

Deploy the token on testnet; onboard a pilot cohort of power users; hold weekly KPI huddles; and surface UX pain points in real time via a leadership Slack channel.

Days 61–75 — Harden

Run a third‑party security audit; dry‑run a crisis‑response tabletop exercise; and prepare public KPI dashboards for launch transparency.

Day 76 — Launch (Sinks Only)

Publish token; open burn and lock sinks; monitor real‑time dashboards for anomalous velocity spikes.

Days 77–90 — Controlled Rewards

Activate the faucet in 10 % weekly increments; deliver Friday briefing memos to the board summarising velocity, WR30, and Treasury growth.

Red‑flag scenarios and CEO fixes

- Velocity jumps past 10 turns. Enact a 72‑hour faucet freeze; release a limited‑edition burn sink to absorb excess tokens; communicate actions transparently.

- WR30 slides below 25 %. Introduce a low‑commitment cosmetic sink and run a push notification campaign; offer small airdrop incentives for dormant wallets to return.

- Treasury ratio approaches 15 %. Re‑allocate half of all subsequent burn fees directly to Treasury until the buffer exceeds 25 %.

- Governance vote skewed by spec accounts. Implement a time‑weighted voting delay or raise quorum threshold to neutralise flash‑mob attacks.

Closing note for the boardroom

A token is not a marketing stunt, it is a miniature economy that will be judged by the same fundamentals as any balance sheet. Keep supply honest, give users instant utility, and publish the numbers even when they sting. Align those three habits and speculation turns into stewardship, volatility becomes manageable risk, and your token graduates from promo code to core product.